Global Luxury Property 2025: Key Investment Insights from Top World Cities

- Clement Lai

- Aug 20, 2025

- 3 min read

International property investors, luxury buyers, and Hong Kong overseas investors all share a common goal: to unlock maximum value in today’s dynamic global real estate market. Luxe Living International’s latest data-driven review, for unbiased insights — this is your essential guide to the world’s prime residential trends for 2025.

Dive into our expert analysis of this year’s top cities, key capital value forecasts, rental growth leaders, and the real costs of buying and owning luxury property across the globe.

Cost of Buying, Owning, and Selling in Global Cities

Understanding total transaction costs is foundational for international property success. Our research finds dramatic differences in the percentage costs required to buy, hold, and sell a US$2 million residential property across major markets. Singapore leads as the most expensive city, driven by aggressive stamp duties and transactional taxes for international buyers, with overall costs far outstripping other hotspots like Barcelona and Sydney. By contrast, mainland China cities—including Shanghai, Hangzhou, Guangzhou, and Shenzhen—offer the lowest buy-hold-sell costs, averaging just above 4% of purchase price.

For Hong Kong overseas investors and global real estate investment strategists, Asian markets (excluding Singapore) remain highly competitive, with total additional costs notably below Western markets. It’s vital to budget for each stage: up-front taxes, ongoing property holding costs, and exit fees—our cost breakdown makes portfolio planning frictionless.

Rental Growth by City: Where Yields Are Rising Fastest

The first half of 2025 spotlights Tokyo, Los Angeles, Cape Town, and Berlin as top-performing cities for six-month rental growth. These hubs have witnessed robust rental price gains, supported by tight supply, international tenant demand, and strong local economies. Investors should note that 23 out of 30 tracked global markets reported rental increases, with cities like Hong Kong, Guangzhou, and London seeing relative declines due to policy shifts and ample inventory.

For those focused on residential rental trends, targeting markets with high six-month growth is key for generating returns and managing risk. Tokyo, Cape Town, and Berlin emerge as prime candidates for maximizing rental yield.

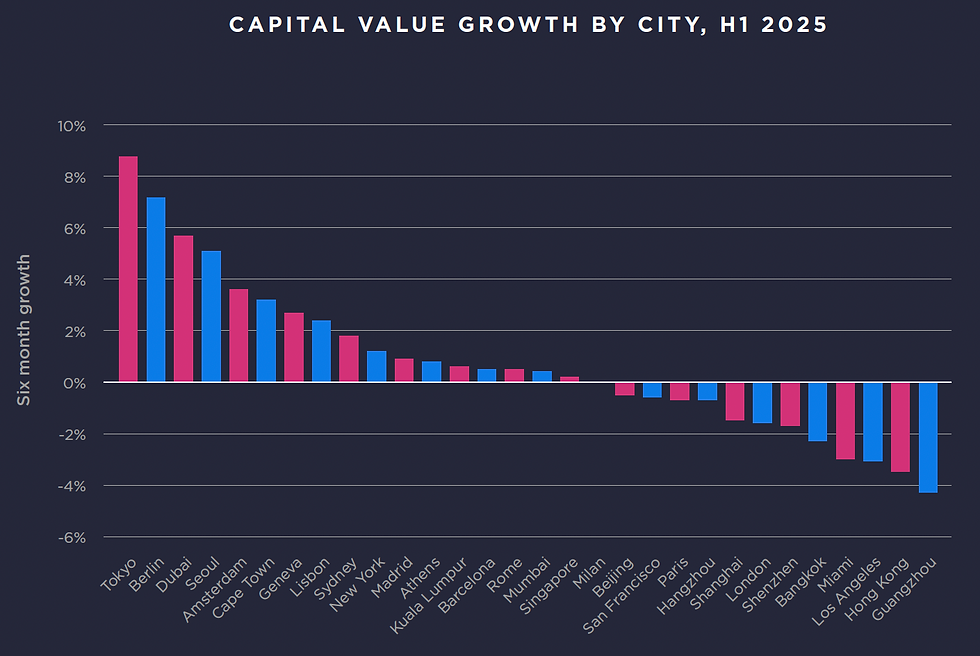

Capital Value Growth by City: H1 2025 Analysis

Recent six-month data confirms stellar performance in Tokyo, Berlin, Dubai, and Seoul, each posting 5%–9% capital value increases. These results reflect the powerful combination of constrained new supply and resilient demand. Meanwhile, markets such as Shanghai, Shenzhen, Bangkok, and Hong Kong have struggled, with capital values softening due to policy interventions and macroeconomic headwinds.

For international property investors, it’s crucial to identify cities with supply-demand imbalances, lifestyle appeal, and proven resilience to global volatility for superior capital value growth.

World Cities Capital Value Forecasts: H2 2025 Outlook

Looking ahead, Luxe Living International predicts the strongest capital value growth through the rest of 2025 will come from Tokyo, Seoul, Cape Town, Dubai, Sydney, and Lisbon, each forecasting up to 7.9% price appreciation. Cities such as Mumbai, Madrid, and Amsterdam also maintain healthy momentum with up to 3.9% growth expected.

On the flip side, select global cities—including Los Angeles, Miami, New York, and London—are forecast to see flat or declining values, making them riskier bets for growth-focused investors. Beijing, Hong Kong, Paris, and Berlin are projected to remain stable, offering safety in uncertain times.

Global Trend Lines: Prime Residential Capital and Rental Growth

Zooming out, our longitudinal trend chart reveals an important truth: rental values in prime global markets are now outpacing capital value growth, highlighting a broader investor preference for income-generating assets in uncertain times. As flexibility and liquidity become paramount, rental-focused strategies are becoming increasingly attractive among high-net-worth individuals, especially in Asia and Europe.

Luxe Living International’s Takeaway for 2025 Investors

• Top picks for capital growth and yields: Tokyo, Seoul, Cape Town, Dubai, Sydney.

• Markets for stable long-term asset value: Berlin, Paris, Hong Kong, Shanghai.

• Risk management: Be cautious in markets with policy risk or price stagnation: London, New York, Los Angeles, Guangzhou.

• Cost optimization: Asian cities (excluding Singapore) offer competitive transaction costs, making them prime choices for overseas buyers.

Our actionable global real estate forecasts are crafted to help you identify winners and avoid risk in today’s complex market.

Ready to unlock the best opportunities in international property and luxury real estate investment? Contact Luxe Living International today to schedule your personalized consultation, and let our team of experts design your optimal global property strategy. Don’t miss out—your prime portfolio advantage begins here!

Comments